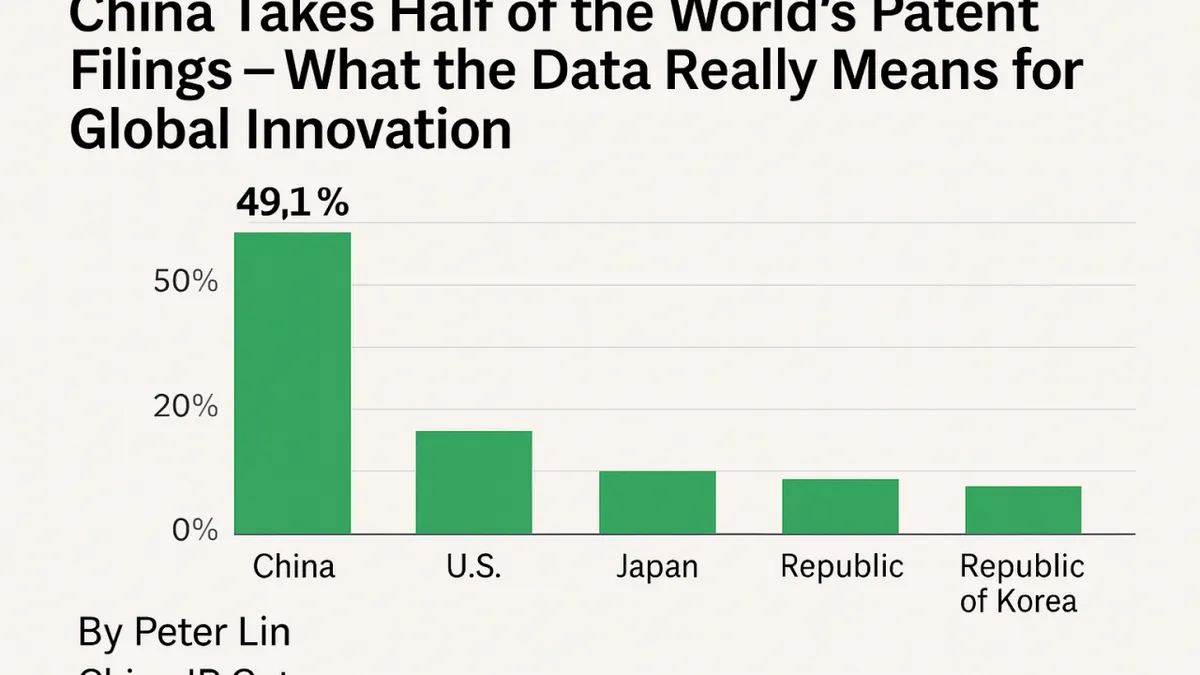

China Takes Half of the World’s Patent Filings — What the Data Really Means for Global Innovation

But instead of only looking at the number, I want to break down the structure behind it — and what it signals for global innovation.

Here are the three essential shifts I think matter most.

Article content The Way of IP 🔍 1. Why are China’s filings so high? It’s not “volume chasing” — it’s market structure + national strategy.

In 2024, Chinese applicants filed 1.8 million invention patents. This isn’t a coincidence. Two forces are driving it:

① China’s massive domestic market demands rapid innovation. Fast product cycles Dense supply chains High competition across industries Patents act as a key defensive moat

See content credentials Article content In such a large internal market, domestic filings will naturally concentrate.

② China is actively positioning high tech as the next economic growth engine. This part is important. China’s national strategy is now heavily oriented toward innovation, advanced manufacturing, and deep tech.

📌 So the high numbers are not an “anomaly” — they are the outcome of both structure and policy.

🔍 2. Why is China’s overseas filing ratio lower? It reflects different economic models, not different levels of ambition.

This is the most misinterpreted WIPO number:

China: 6.9% of filings go overseas US: 46% Japan: 43% Germany: 51%

People often jump to conclusions, but the explanation is simpler:

China’s innovation is anchored in a huge domestic market. Companies build their defensive position at home first, then expand overseas based on business needs.

US, Japan, and Europe operate with global supply chains from day one. Their IP naturally follows international markets.

📌 These are two different innovation pathways — not “better or worse.”

🔍 3. From my own work at openPTO: China’s overseas patent activity is clearly accelerating.

Beyond the statistics, my daily work gives me a very practical view:

More Chinese companies are globalizing than ever before PCT filings and US/EU/JP national filings are rising steadily Overseas litigation risks are pushing companies to plan ahead Clients are shifting from “domestic protection only” → to “global positioning”

📌 China’s global patent layout is not slow — it’s in its acceleration phase. The next 3–5 years will be a structural turning point.

🌍 What does this mean for global innovators? Two opportunity windows are opening:

✓ Opportunity 1: Cross-border technical collaboration will grow rapidly. As Chinese companies globalize, we will see more:

Joint R&D Co-patenting Technology licensing Standard-setting collaboration International manufacturing partnerships

✓ Opportunity 2: Demand for cross-border IP services will enter a long growth cycle. This directly affects:

Patent attorneys IP lawyers Technology startups R&D institutions Investors

China’s global expansion unlocks a new layer of IP demand.

📌 Key Takeaways China’s filing volume is driven by both market scale and national innovation strategy The lower overseas ratio reflects a stage of development, not a weakness China’s international filings are now clearly accelerating Global innovators will see increasing collaboration and service opportunities

In the next issue, I’ll cover an equally important question:

Why is China number one in “patent density,” yet still has a relatively small share of multi-jurisdiction patent families? And what does that mean for the next decade of global tech competition?